A PEACE OF MIND

Recently, we attended AXA SmartFamily launch, it made us realised that insurance is not just about the management of stress but also a peace of mind when something happens. As parents, we tend to worry about everything and we are often over-protective – because that is in our DNA to take care of our children when all they have is us.

AXA launched a very unique type of personal insurance plan and it goes beyond financial coverage, it is a well thought personal plan to address family issues after accidents happen. The AXA SmartFamily offers a suite of 8 services which helps smoothen daily disruptions during various stage of recovery so that one can have a peace of mind and one’s family well taken care by AXA.

AXA SmartFamily plan is designed by parents like us:

[embedplusvideo height=”350″ width=”620″ editlink=”http://bit.ly/1RcLC1v” standard=”http://www.youtube.com/v/_U22zf4no7k?fs=1″ vars=”ytid=_U22zf4no7k&width=620&height=350&start=&stop=&rs=w&hd=0&autoplay=0&react=1&chapters=¬es=” id=”ep2876″ /]

AXA SmartFamily’s 8 services that are essential to one’s recovery:

- Child Guardian – Arranging and paying for our children transport to school;

- Home Nursing – Arranging and paying for a nurse to attend to post-accident treatments or therapy at home;

- Consultation with a Therapist – Making appointments and payment for our therapy or rehabilitation services;

- Doctor’s Home Visits – Arranging and paying for a doctor’s visit for our follow up treatments;

- Home Modification – Arranging and paying for modification to our home to accommodate our disability;

- Transportation for Medical Appointments – Arranging and paying for transportation (i.e. taxi service) to the hospital/clinics for follow up treatments;

- Housekeeping & Meal Services – Arranging and paying for professional house cleaning and meal services;

- Psychologist Consultation – Making appointments and payment on our behalf for psychologist consultations.

Freedom of coverage choice –

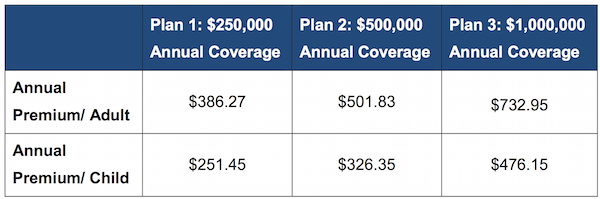

A plan with 3 different ranges of sum insured ($250,000, $500,000 and $1 million) to choose from to suit our needs.

Please see Illustration 1 below for discounted annual premiums for a family.

Only one overall coverage cap per plan – helps us to track the cost of benefits we would like to claim as long as it is within the total coverage we purchased. For example, if you purchased a $1 million sum insured, you can utilise the 8 services in any proportion (which will be available for usage, depending on the stages of recovery), till the total amount of cost usage reaches your $1 million sum insured.

Cashless payment – through the AXA Assistance Network, one will not need to pay upfront cash payments.

For more information on AXA Singapore and AXA SmartFamily, please visit www.axa.com.sg.